Mastering Bid Bonds: A Contractor’s Strategic Guide

The construction bidding process represents a critical juncture where contractors compete for lucrative projects that can define their business trajectories. In this competitive environment, project owners need assurance that bidders possess both the serious intent and financial capability to execute work if selected. Bid bonds serve this essential gatekeeping function, separating qualified contractors from those who cannot deliver on their proposals. For contractors throughout Florida and Georgia, understanding the nuances of bid bonds and working with experienced providers like Guignard Company—a leading Tampa FL construction surety bid bond provider—can mean the difference between winning competitive projects and being excluded from consideration.

What Are Bid Bonds and Why Are They Required?

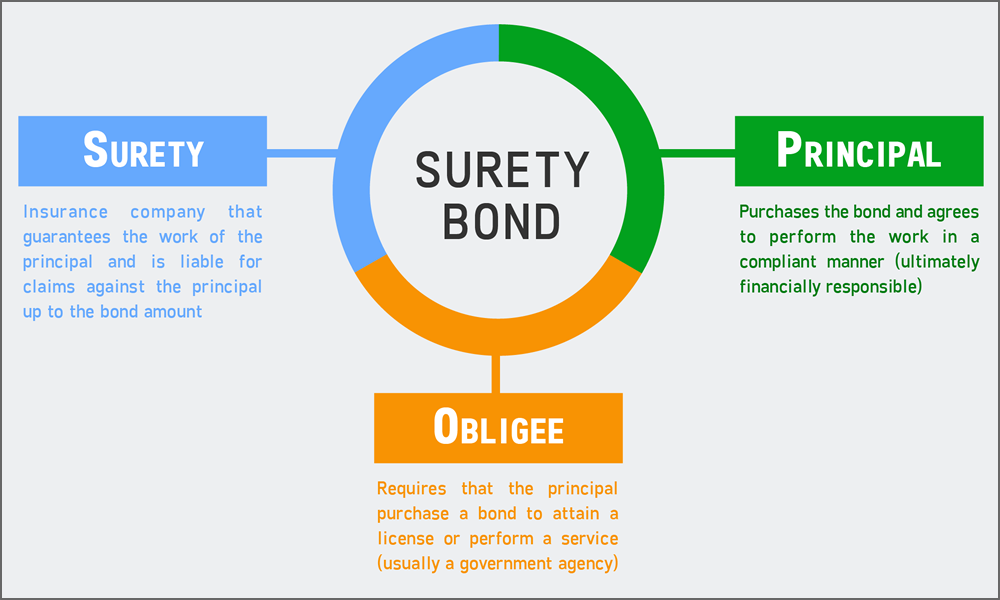

A bid bond is a specialized type of surety bond that guarantees contractors will honor their bids if selected for construction projects. This three-party agreement involves the contractor (principal) who submits the bid, the project owner (obligee) who receives bids, and the surety company (guarantor) that backs the contractor’s commitment. When contractors include bid bonds with their proposals, they’re essentially providing project owners with financial assurance that they won’t withdraw from contracts after winning competitive selections.

The fundamental purpose of bid bonds extends beyond simple contract enforcement. These bonds serve multiple strategic functions in the construction procurement ecosystem. First, they discourage frivolous or unrealistic bidding by requiring contractors to undergo surety underwriting before submitting proposals. This pre-qualification filters out unserious bidders who might otherwise waste project owners’ time with artificially low bids they cannot honor. Second, bid bonds provide project owners with financial recourse if winning contractors refuse to proceed, compensating owners for the cost differential between the withdrawn bid and the next acceptable proposal. Third, bid bonds signal to project owners that contractors have been vetted by professional surety underwriters and possess the financial strength necessary to complete projects successfully.

For contractors working with an Orlando surety bid bond provider, obtaining bid bonds opens doors to projects that would otherwise be inaccessible. Many of the most profitable opportunities—particularly government contracts and large commercial developments—require bid bonds as mandatory prerequisites for proposal submission. Contractors without bonding capability simply cannot compete in these markets, making bid bond access a fundamental business capability rather than an optional enhancement.

The Mechanics of How Bid Bonds Function

Understanding the operational mechanics of bid bonds helps contractors navigate the bidding process more effectively:

Pre-Bid Phase: Before submitting proposals on bonded projects, contractors must secure bid bonds from surety companies. This requires coordination with surety agents or brokers who facilitate relationships between contractors and surety carriers. For contractors with established bonding programs, obtaining bid bonds can occur quickly—sometimes within hours for urgent opportunities. New contractors without existing surety relationships face longer timelines as sureties conduct initial underwriting.

Bond Issuance: Once approved, sureties issue bid bonds specifying penalty amounts typically ranging from 5% to 20% of proposed bid values, as dictated by project bid documents. The bond becomes effective on the bid opening date and remains valid for specified periods—commonly 60 to 90 days—giving project owners time to evaluate proposals and award contracts.

Bid Submission: Contractors include bid bonds with their complete bid packages, demonstrating pre-qualification and serious intent. The mere presence of a properly executed bid bond from a qualified surety significantly enhances bid credibility in project owners’ eyes.

Post-Bid Scenarios: After bid opening, several outcomes can unfold:

If the contractor wins the bid and proceeds by signing the contract and providing required performance and payment bonds, the bid bond releases with no claims or penalties. The contractor has fulfilled the bid bond’s purpose by honoring their proposal.

If another contractor wins the project, the unsuccessful bidder’s bid bond simply releases with no further obligations. Bid bonds only create liability for winning contractors who fail to proceed.

If the contractor wins but refuses to sign the contract or cannot secure required performance and payment bonds, they default on the bid bond obligation. The surety must then compensate the project owner for damages up to the bid bond penalty amount, typically covering the difference between the defaulting contractor’s bid and the next lowest responsive bid.

Financial Consequences of Default: When contractors default on bid bonds, consequences extend beyond immediate surety payments to project owners. The surety will pursue the contractor and their principals for reimbursement through indemnity agreements signed during the bond application process. Additionally, bid bond defaults severely damage bonding relationships, often resulting in bonding capacity termination and difficulty obtaining bonds from other sureties. Industry reputation suffers as well, potentially affecting unbonded opportunities through damaged credibility.

Bid Bond Requirements Across Different Project Types

Bid bond requirements vary significantly between public and private construction sectors:

Public Sector Projects: Federal, state, and local government construction almost universally requires bid bonds as part of standardized procurement processes. The Miller Act mandates bonding on federal contracts exceeding $150,000, while state “Little Miller Acts” impose similar requirements on state and municipal projects with varying thresholds—some as low as $25,000 in certain jurisdictions.

Public sector bid bonds serve important policy objectives beyond protecting individual projects. They promote fair competition by ensuring only qualified contractors participate in public procurement. They protect taxpayer investments by preventing bid shopping and strategic bid withdrawal. They maintain integrity in government contracting by holding bidders accountable to their proposals through financial guarantees.

Public sector bid bonds typically require specific surety qualifications. Federal projects mandate bonds from sureties appearing on the U.S. Department of Treasury’s approved list (T-List), ensuring surety companies meet federal financial standards. Many states maintain similar approved surety lists with additional state-specific requirements.

Private Sector Projects: Private project owners exercise discretion regarding bid bond requirements. Sophisticated developers, institutional property owners, and major corporations frequently require bid bonds on significant projects, recognizing their value in qualifying bidders and ensuring commitment. However, smaller private projects often proceed without bid bond requirements, though many contractors voluntarily provide them to demonstrate credibility.

Private sector bid bonds offer more flexibility than statutory public bonds. Owners and contractors can negotiate bond amounts, terms, and procedures rather than following rigid statutory frameworks. This flexibility sometimes allows creative approaches to managing bonding requirements for unique project situations.

The Bid Bond Application and Approval Process

Securing bid bonds efficiently requires understanding the application process and preparing appropriate documentation:

Initial Request: When contractors identify bonding opportunities, they contact their surety agents—such as Guignard Company—to discuss projects and request bid bonds. Key information includes project descriptions and scopes, contract values and bid amounts, project owner identities, bid submission deadlines, and any special bonding requirements outlined in bid documents.

Underwriting Evaluation: For new bonding relationships, sureties conduct comprehensive underwriting examining financial statements and strength, relevant project experience, current work backlog and commitments, management capabilities and systems, and overall business stability. Established contractors with existing bonding programs undergo abbreviated evaluations confirming projects fall within approved capacity parameters.

Market Submission: Experienced surety agents like Guignard Company strategically submit bond requests to appropriate surety companies within their networks. As one of the Top Central Florida surety bond providers, we maintain relationships across multiple surety markets, allowing optimal matching between contractors and surety carriers based on project characteristics, contractor profiles, and market appetites.

Rapid Processing: Understanding that bidding deadlines often pressure contractors, professional surety agencies prioritize bid bond requests to ensure timely delivery. For qualified contractors with strong surety relationships, bid bonds can often be issued within 24 hours or less. Even for new relationships, efficient processes typically allow approvals within several business days.

Bond Delivery: Once approved, bid bonds are delivered in formats required by specific projects—physical bond documents, electronic bonds, or certified copies for inclusion in bid packages. Modern electronic delivery systems increasingly streamline this final step, allowing immediate digital transmission.

Factors Affecting Bid Bond Approval and Capacity

Several variables influence whether contractors can obtain bid bonds and what capacity limits apply:

Financial Strength: Surety underwriters carefully analyze contractor financial positions focusing on working capital adequacy, profitability consistency, debt management, and equity strength. Strong financials facilitate bid bond approvals and support higher capacity levels, while weak financial positions create obstacles.

Relevant Experience: Contractors must demonstrate experience with projects similar to those they’re bidding in terms of size, complexity, type, and delivery method. Attempting to bid on projects outside demonstrated experience areas raises red flags with sureties and may result in bond declinations.

Current Backlog: Sureties evaluate contractors’ current work commitments to ensure they’re not overextended. Taking on new projects while struggling with existing work creates risk that sureties carefully consider. Manageable backlogs relative to resources support additional bid bond capacity.

Bonding History: Contractors with successful bonding track records receive preferential treatment. Completing bonded projects on time, within budget, and without claims builds surety confidence and facilitates easier approvals for future bonds.

Project Characteristics: Specific project features affect bid bond considerations including project size relative to contractor capacity, technical complexity and specialized requirements, project location and logistics, contract terms and risk allocation, and project owner sophistication and stability.

Strategic Bid Bond Management for Competitive Advantage

Sophisticated contractors implement strategic approaches to bid bond management that enhance competitive positioning:

Proactive Bonding Relationship Development: Rather than waiting until specific bid opportunities arise, successful contractors establish surety relationships well in advance. This involves meeting with surety agents to discuss business plans and growth objectives, submitting financial statements and company information for preliminary underwriting, obtaining initial bonding capacity commitments, and maintaining regular communication about upcoming opportunities.

Capacity Planning and Allocation: Since bid bonds count against aggregate bonding capacity until released, contractors must strategically manage capacity allocation. This requires tracking all pending bids and their bid bond requirements, prioritizing opportunities with highest win probabilities or profitability potential, timing bid submissions to avoid capacity crunches, and communicating with sureties about capacity needs for specific bid seasons.

Bid Selection Discipline: Not every opportunity deserves pursuit, and bid bond capacity constraints reinforce the importance of selective bidding. Successful contractors carefully evaluate whether projects align with capabilities and experience, whether profit potential justifies bonding capacity commitment, whether project owners and contracts present reasonable risk profiles, and whether adequate resources exist to execute work if awarded.

Financial Management for Bonding: Understanding that financial strength drives bonding capacity, strategic contractors manage finances with bonding implications in mind. This includes maintaining strong working capital through profitable operations, limiting owner distributions to preserve capital, managing debt levels conservatively, preparing high-quality financial statements regularly, and building retained earnings systematically.

Common Bid Bond Challenges and Solutions

Contractors occasionally encounter obstacles in obtaining bid bonds, but awareness of common challenges enables proactive solutions:

Challenge: Tight Bidding Deadlines

Discovering bonding requirements shortly before bid submission deadlines creates time pressure that can jeopardize participation.

Solution: Review bid documents immediately upon deciding to pursue opportunities, ideally when first receiving project information. Contact surety agents early in the estimating process to discuss bonding requirements and initiate preliminary approvals. Establish relationships with responsive agencies like Guignard Company that prioritize quick turnarounds.

Challenge: Capacity Constraints

Contractors with multiple simultaneous bids or substantial existing bonded work may exhaust available capacity, preventing additional bid bond issuance.

Solution: Plan bid timing strategically to manage capacity efficiently. Focus on highest-priority opportunities. Communicate with sureties about upcoming needs to explore temporary capacity increases. Consider completing existing projects before pursuing new opportunities to free capacity.

Challenge: Limited Bonding History

New contractors without established bonding track records face higher scrutiny and sometimes capacity limitations that restrict the size of projects they can bid.

Solution: Start with smaller bonded projects to establish successful completion records. Provide comprehensive documentation of relevant experience including work performed for other companies. Consider partnership opportunities with established contractors on initial projects. Work with agents experienced in placing emerging contractors.

Challenge: Financial Statement Timing

Bonding opportunities sometimes arise between fiscal year-ends or before annual financial statements are compiled, creating documentation challenges.

Solution: Maintain current interim financial statements throughout the year. Many sureties accept internally-prepared quarterly financials supplemented by year-end reviewed or audited statements. Work with CPAs to prepare timely financials demonstrating responsiveness and professionalism.

The Economics of Bid Bonds: Costs and Value Proposition

Understanding bid bond costs helps contractors evaluate economic implications:

Premium Structure: Bid bond premiums are among the most economical surety products, typically ranging from a few hundred to several thousand dollars depending on bid amounts. Many sureties charge flat fees for bid bonds, while others calculate small percentages of bond penalty amounts.

Cost Recovery: When contractors win bids and proceed to obtain performance and payment bonds, most sureties credit bid bond premiums against final bond costs or include them in overall program pricing, essentially making bid bonds free or very low cost. Contractors pay only when unsuccessful on multiple bids without winning projects.

Value Delivered: Despite modest costs, bid bonds deliver substantial value by enabling access to lucrative projects contractors couldn’t otherwise pursue, demonstrating financial credibility to project owners, signaling serious intent and professional capability, and facilitating competitive positioning against contractors without bonding capacity.

Comparative Advantage: Bid bonds create barriers to entry that limit competition. Projects requiring bonds automatically exclude contractors who cannot obtain them, potentially reducing the number of competitors in specific bid situations and creating opportunities for bonded contractors to win more work at better margins.

Bid Bonds and Final Bond Continuity

Bid bonds represent just the first step in comprehensive bonding sequences:

Seamless Transition: When contractors win bids, the surety companies providing bid bonds expect to issue corresponding performance and payment bonds. This continuity is inherent in the bid bond concept—sureties wouldn’t guarantee contractors will provide final bonds unless prepared to issue those bonds themselves.

Consistent Underwriting: Terms established during bid bond underwriting typically carry forward to performance and payment bonds. Premium rates, capacity allocations, and underwriting requirements remain consistent across the bonding sequence, though material changes in project scope or terms may require additional review.

Project Monitoring: Once projects commence under performance and payment bonds, sureties monitor progress through various mechanisms including financial statement reviews, work-in-progress reports, periodic jobsite inspections for larger projects, and communication with contractors about challenges or changes.

Technology’s Impact on Bid Bond Processes

Modern technology continues to transform bid bond procedures:

Electronic Bonds: Many jurisdictions now accept electronic bid bonds submitted through online bidding platforms. Digital bonds provide instant delivery, eliminate physical document handling, automatically track bond status and expirations, and integrate with electronic bidding systems for seamless submission.

Online Portals: Progressive surety agencies offer online portals where contractors can submit bond requests digitally, upload financial documents electronically, track application status in real-time, and receive issued bonds instantly via digital delivery.

Automated Underwriting: For established contractors with strong surety relationships, some bid bonds can be issued through automated systems that approve requests within minutes based on pre-established parameters and contractor financial profiles stored in surety databases.

Working with Guignard Company for Bid Bond Success

Guignard Company’s approach to bid bond services emphasizes responsiveness, market knowledge, and genuine partnership:

Quick Response Times: Understanding that bidding deadlines create urgency, we prioritize bid bond requests to ensure contractors receive bonds in time for proposal submissions. Our streamlined processes and strong surety relationships facilitate rapid approvals.

Broad Market Access: As a bid bond provider in Atlanta, GA and throughout the Southeast, we maintain relationships with over 20 surety companies, providing access to multiple markets and finding optimal matches for contractor situations.

Strategic Guidance: Beyond processing individual bond requests, we help contractors develop comprehensive bonding strategies supporting long-term growth. This includes capacity planning, financial management guidance, and market expansion strategies.

Personalized Service: We take time to understand each contractor’s unique circumstances, capabilities, and objectives, tailoring our approach to specific needs rather than applying one-size-fits-all solutions.

Contact Guignard Company for Your Bid Bond Requirements

Whether you’re pursuing your first bonded project or managing multiple simultaneous bids across various markets, Guignard Company provides the expertise, market access, and responsive service contractors need to compete effectively. Our commitment to understanding your business goals allows us to provide strategic guidance extending beyond individual transactions to support long-term success.

Orlando Office

1904 Boothe Circle

Longwood, FL 32750

Phone: 407-834-0022

Serving Central Florida contractors with rapid bid bond approvals for commercial construction, public works, and infrastructure projects throughout the Orlando metropolitan area.

Tampa Office

1219 Millennium Pkwy, Ste 113

Brandon, FL 33511

Phone: 813-547-3773

Supporting Tampa Bay contractors with expert bid bond services and comprehensive surety solutions for projects throughout the Gulf Coast region.

Atlanta Office

Deerfield Corporate Center One

13010 Morris Rd, Ste 600

Alpharetta, GA 30004

Phone: 678-606-5533

Assisting Georgia contractors with competitive bid bond programs and strategic bonding guidance for projects throughout the Southeast.

Bid bonds represent far more than administrative requirements—they’re strategic tools that open doors to profitable opportunities while demonstrating financial credibility and professional capability. Understanding how bid bonds function, maintaining strong surety relationships, and working with experienced professionals positions contractors for competitive advantage in today’s construction markets.

Guignard Company’s extensive experience helping contractors secure bid bonds, combined with our comprehensive surety market relationships and commitment to responsive service, ensures you receive the bonding support necessary to pursue opportunities confidently. From obtaining your first bid bonds to managing sophisticated multi-project bonding programs, our team delivers the expertise and advocacy that separate successful bonded contractors from those who struggle with surety access.

Contact us today to discuss your upcoming bid opportunities and discover how our bid bond expertise can help you compete for and win the projects that drive your business forward. Our professionals stand ready to provide the rapid approvals, strategic guidance, and market advocacy essential for construction business growth and success.